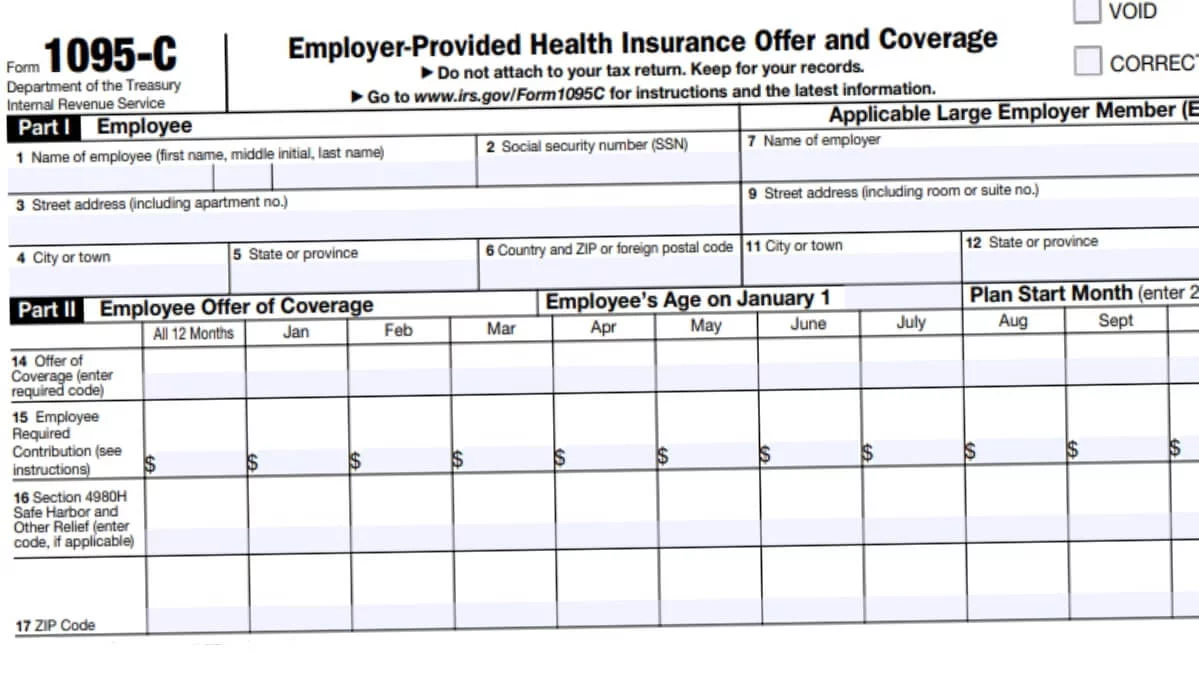

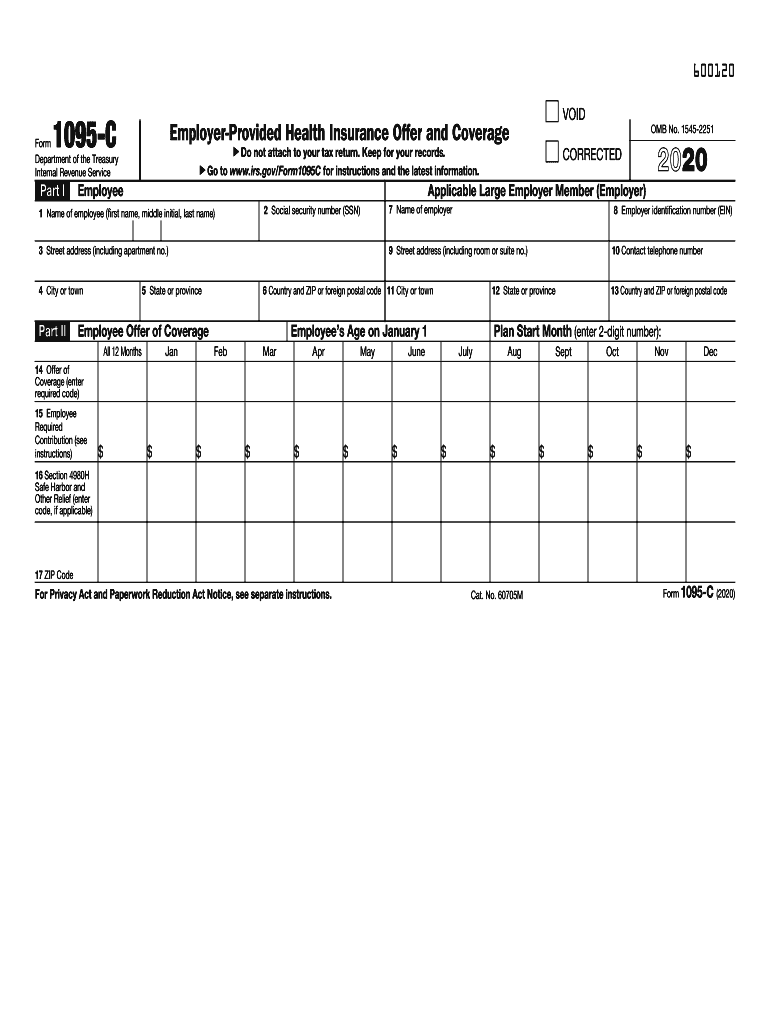

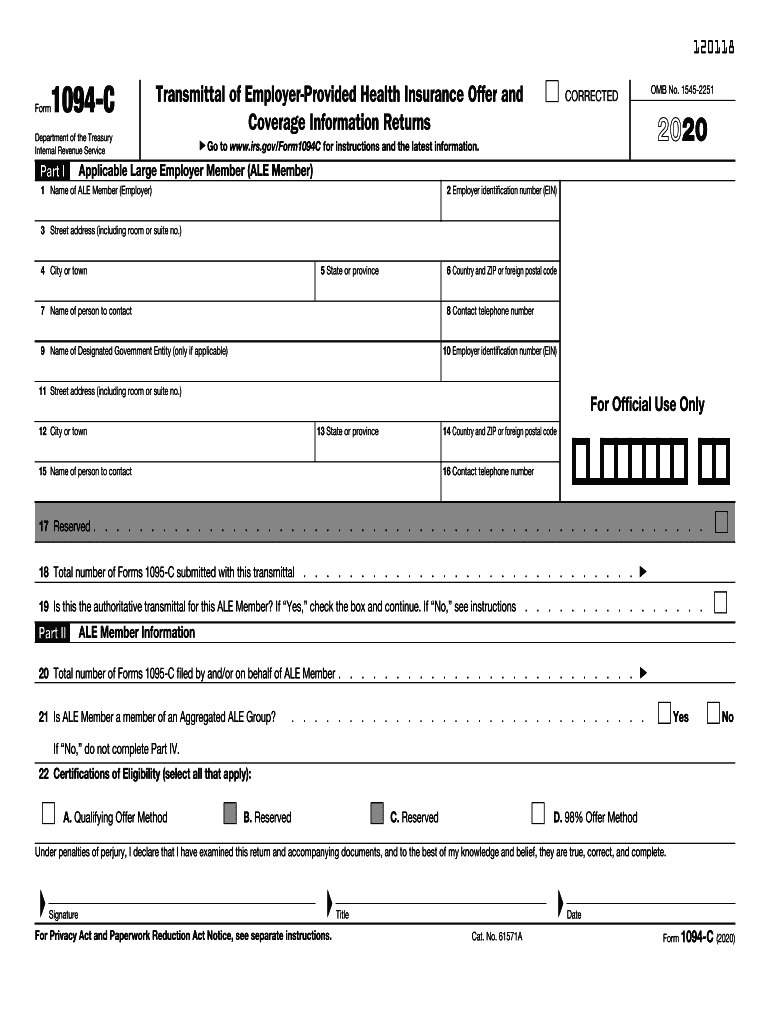

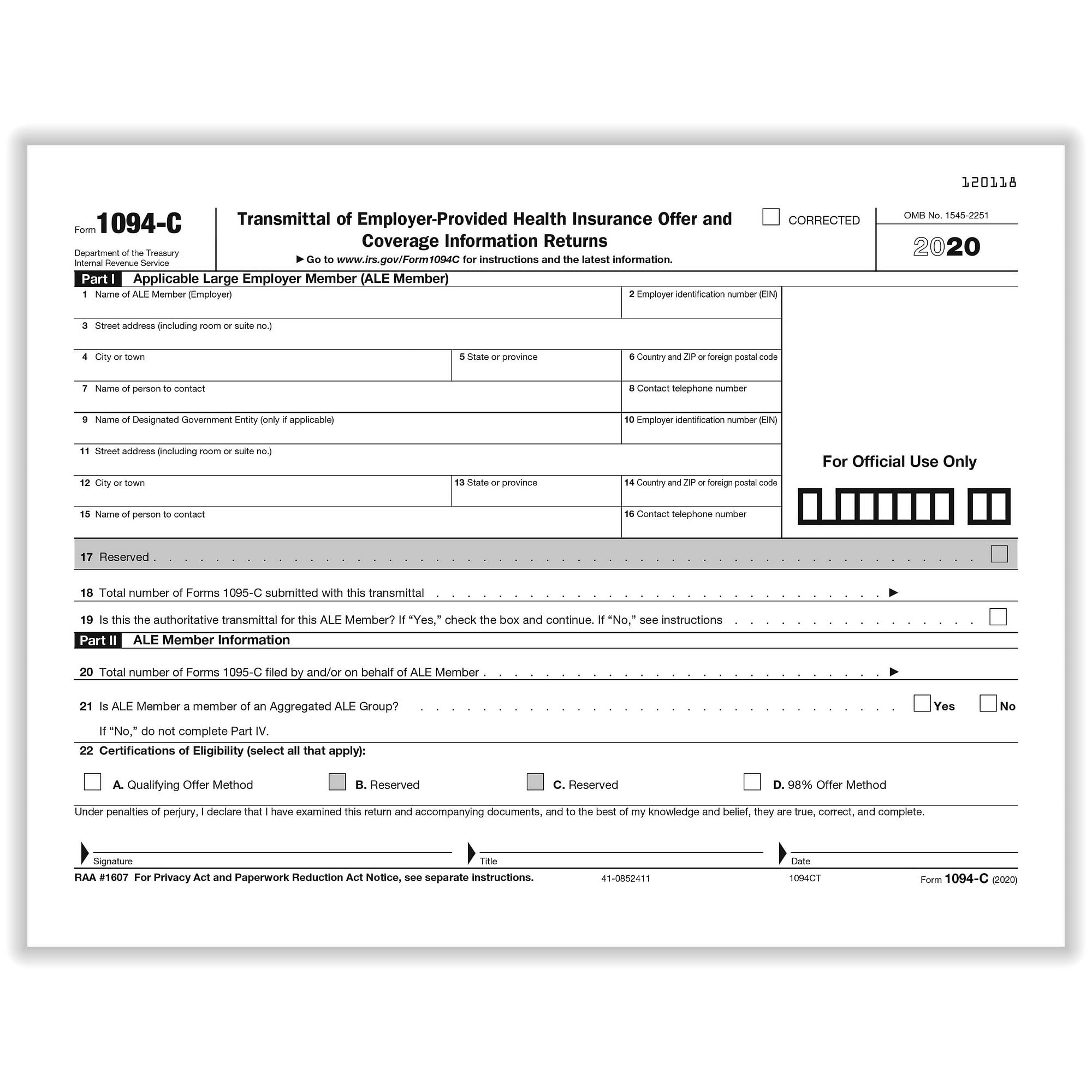

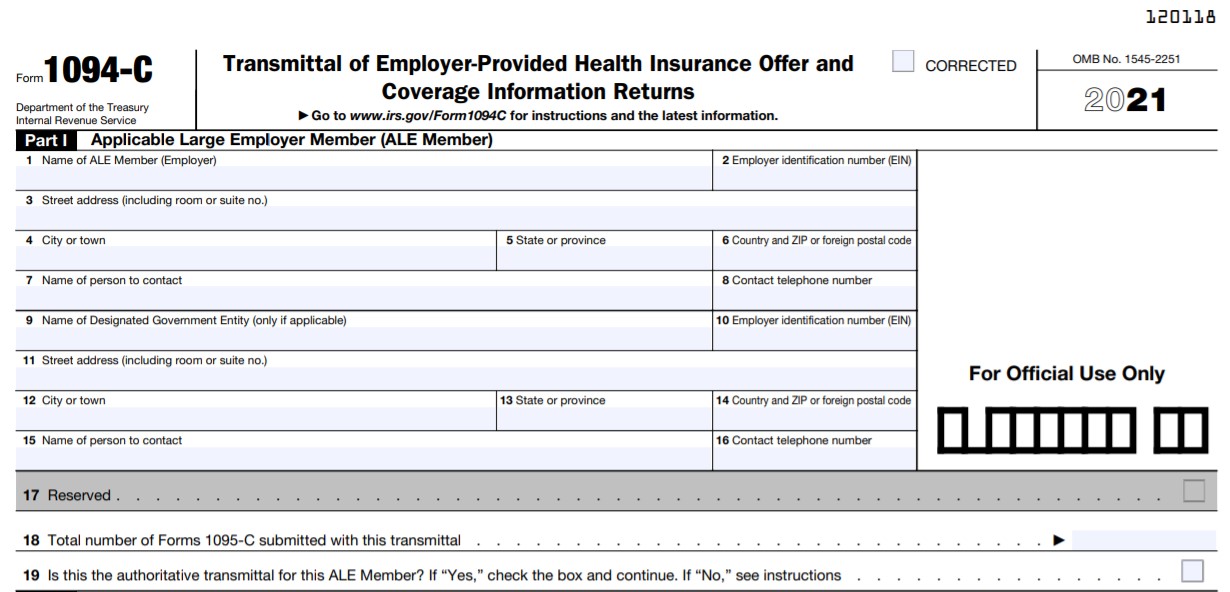

CODES FOR IRS FORM 1095C relief is described under Offer of Health Coverage in the Definitions section on page 16 of the 19 Instructions for Forms 1094C and 1095C from the IRS Note Although ALE Members may use the section 4980H affordability safe harbors to determine affordability for purposes Form 1094B Form 1095B Form 1094C Form 1095C The IRS also released full instructions for Forms 1094C and 1095C for employers and HR teams, as well as instructions for Forms 1094B and 1095B Updates for Versions A few key updates were made to FormGet And Sign 1094 C Form 15 Province 6 Country and ZIP or foreign postal code 7 Name of person to contact 8 Contact telephone number 9 Name of Designated Government Entity (only if applicable) 10 Employer identification number (EIN) 11 Street address (including room or suite no)

Form 1094 C And 1095 C And Other Ale Consultations Haffraggiolaw

Form 1094 c instructions 2020

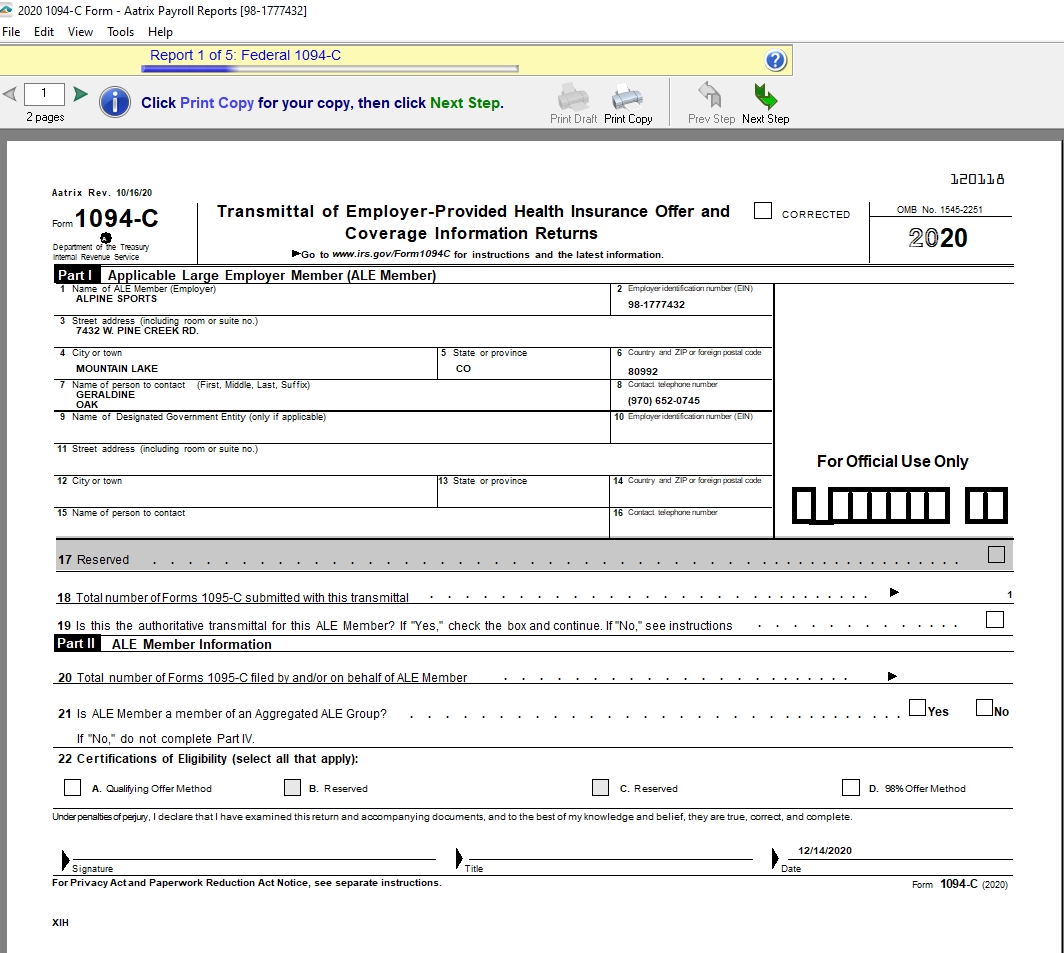

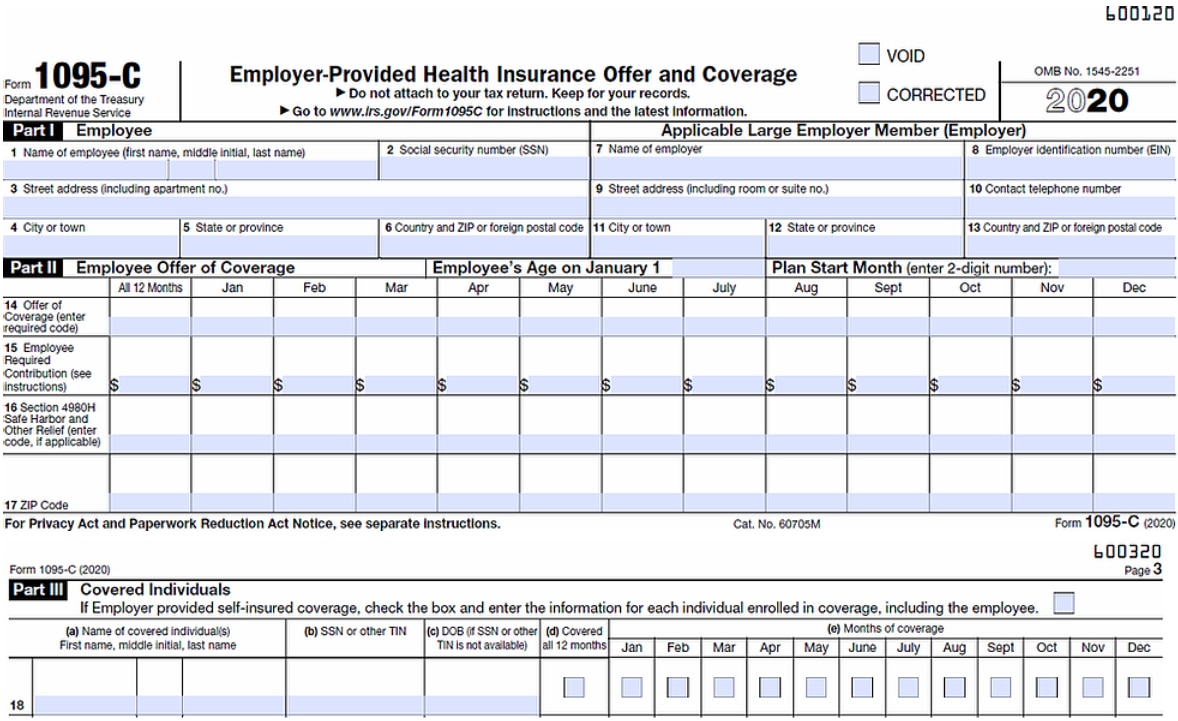

Form 1094 c instructions 2020-If a substitute form is used, this form must meet all the content requirements of the IRS and should include every piece of information needed for Form 1094C and Form 1095C In 17, the IRS provided draft instructions for forms 1094, 1095, and other forms required for ACA reportingForm 1094C gets auto generated based on the 1095C forms input inside the system This saves users time and simplifies the filing process As an employer you can think of the 1095C as the W2 form of ACA healthcare reporting and 1094C as the W3 transmittal of ACA reporting

Www Ftb Ca Gov Forms 35b Publication Pdf

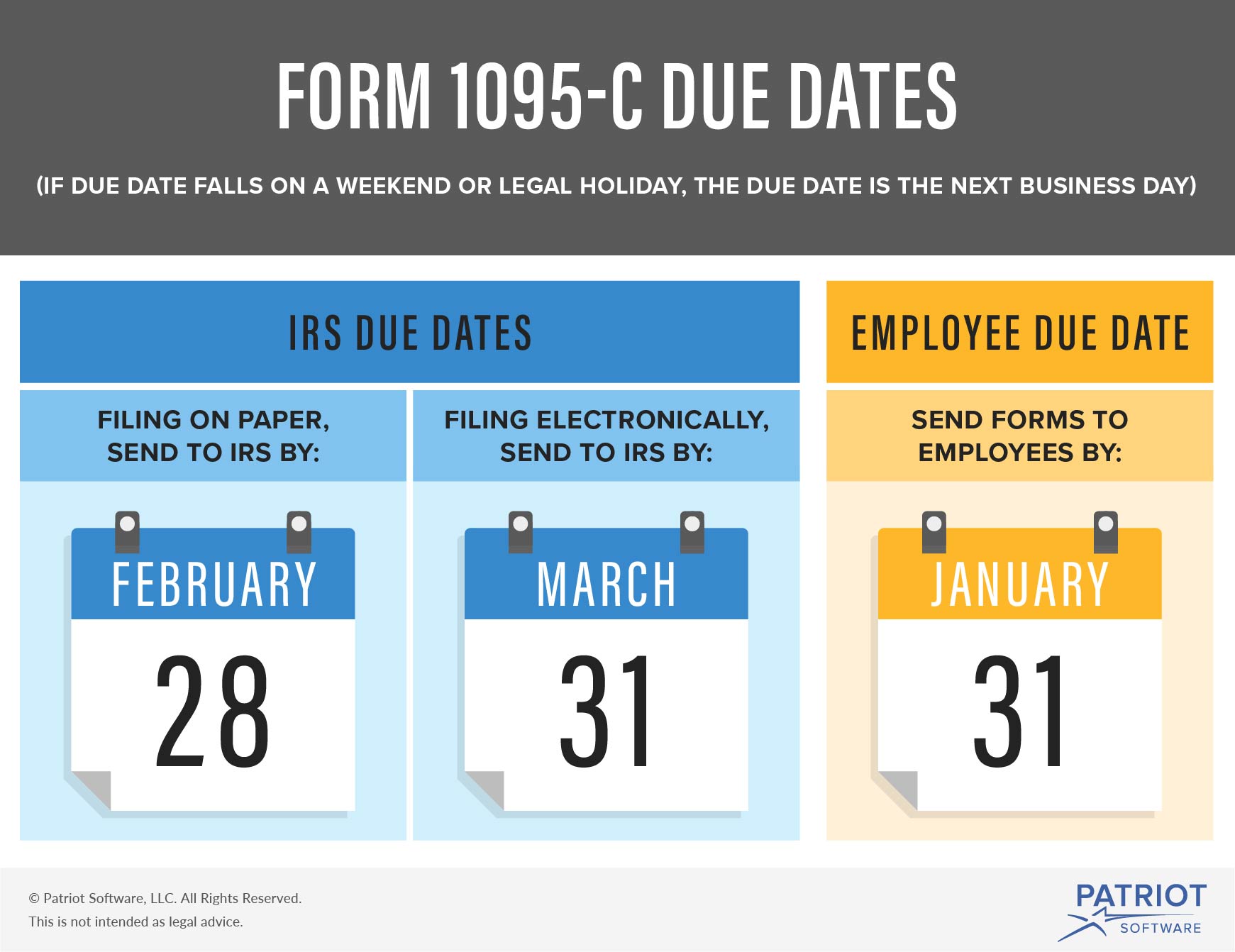

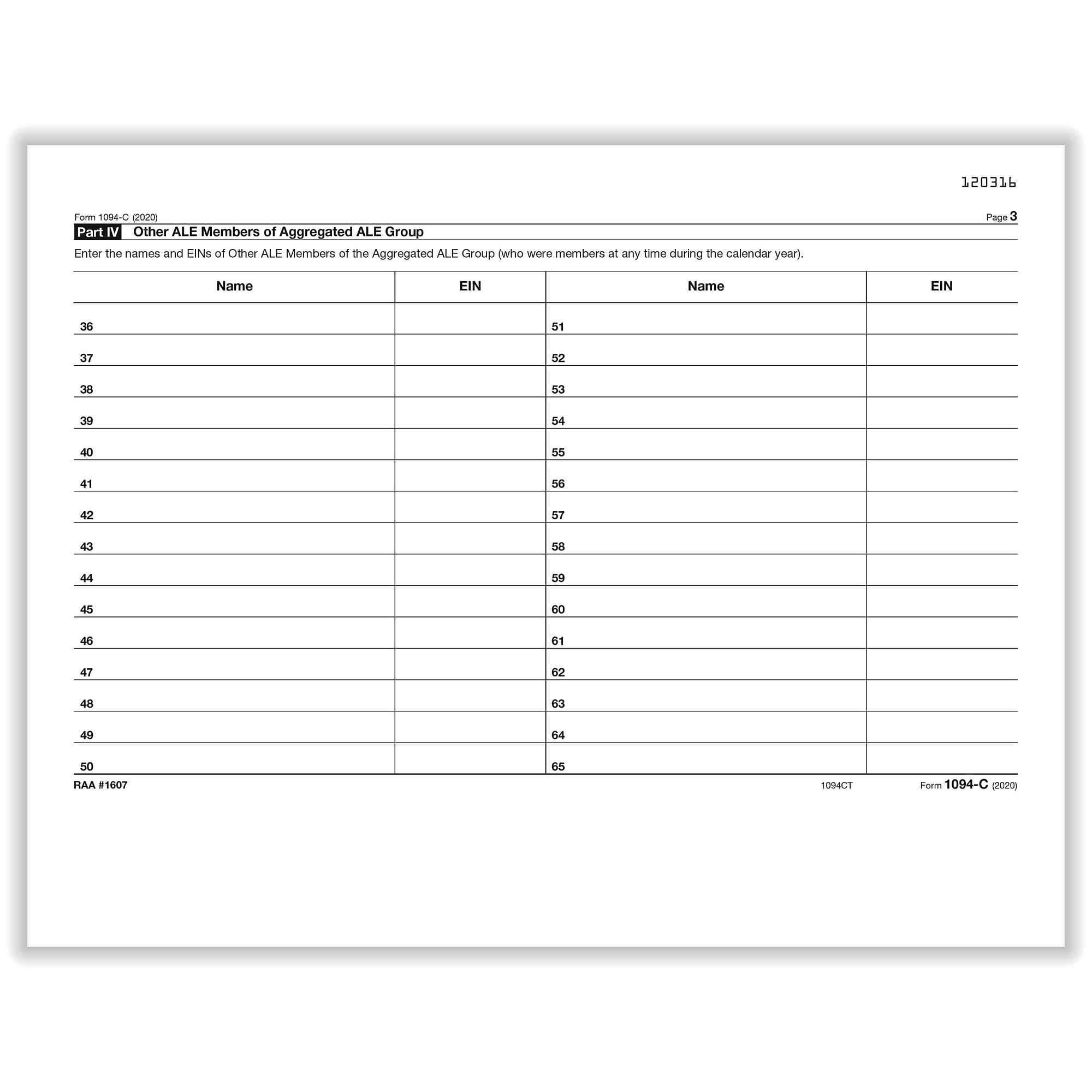

Title Cat No A Date Form 1094C () 1218 Page 2 Form 1094C () Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes 23 No (b) Section 4980H FullTime Employee Count for ALE Member (c) Total Employee Count for ALE Member (d) Aggregated Group Indicator (e) Reserved All 12 Months 24 Jan 25Form 1094C is only sent to the IRS, not to employees Form 1094C 19 Tax Year Deadlines Due to recipient January 31st, Paper file 1094C with the IRS March 2nd, Efile 1094C with the IRS March 31st, Note IRS has now extended the recipient copy deadline to from the original due date of January 31Editable IRS 1094C 21 Download blank or fill out online in PDF format Complete, sign, print and send your tax documents easily with US Legal Forms Secure and trusted digital platform!

Form 1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2 The Form 1095B or 1095C is furnished to individuals, but Form 1094C is not There are separate deadlines for filing these forms with the IRS and furnishing statements to individuals Filing With IRS ALEs must file the 19 Form 1094C transmittal (and copies of related Forms 1095C) with the IRS by , if they are filing on Form 1095C is furnished to individuals, but Form 1094C is not There are separate deadlines for filing forms with the IRS and furnishing statements to individuals Filing With IRS ALEs must file the 19 Form 1094C transmittal (and copies of related Forms 1095C) with the IRS by , if they are filing on paper

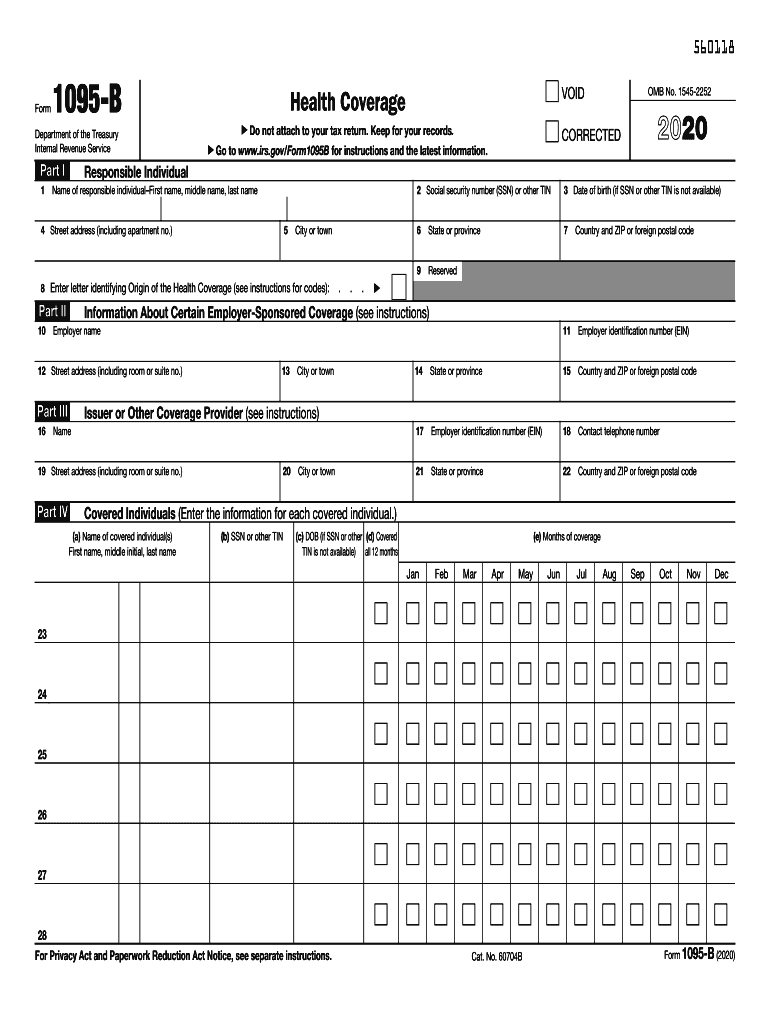

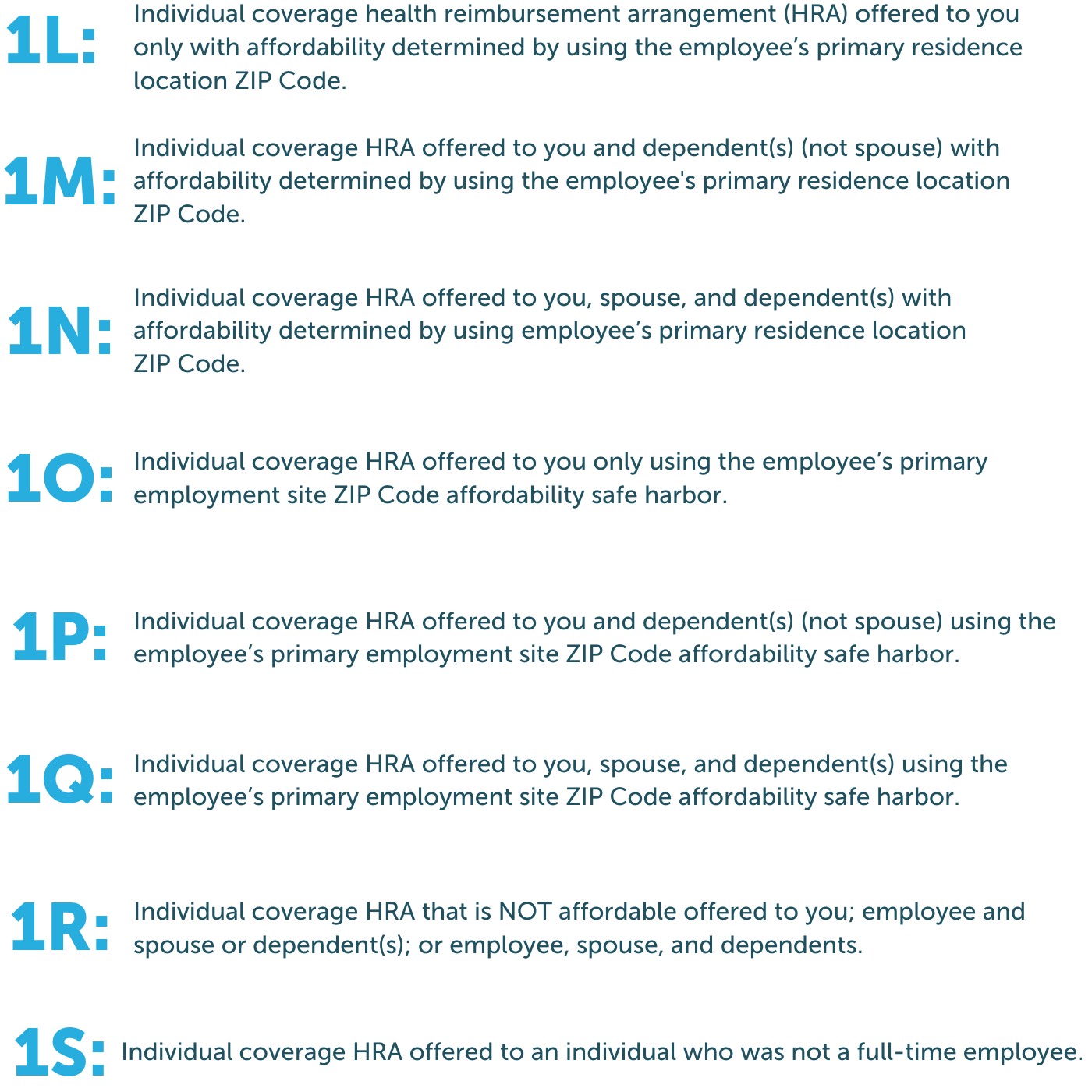

California Instructions for Filing Federal Forms 1094C and 1095C References in these instructions are to the Internal Revenue Code (IRC) as of , and to the California Revenue and Taxation Code (R&TC) The forms and instructions also require employers to include information concerning Individual Coverage Health Reimbursement Arrangements (ICHRAs), if applicable The instructions for Form 1094C state that offers of ICHRA coverage count as offers of minimum essential coverage and both Forms 1095B and 1095C have new codes for informationForm 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Inst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement

Form 1095 A 1095 B 1095 C And Instructions

Irs Final Aca Compliance Forms Now Available Bernieportal

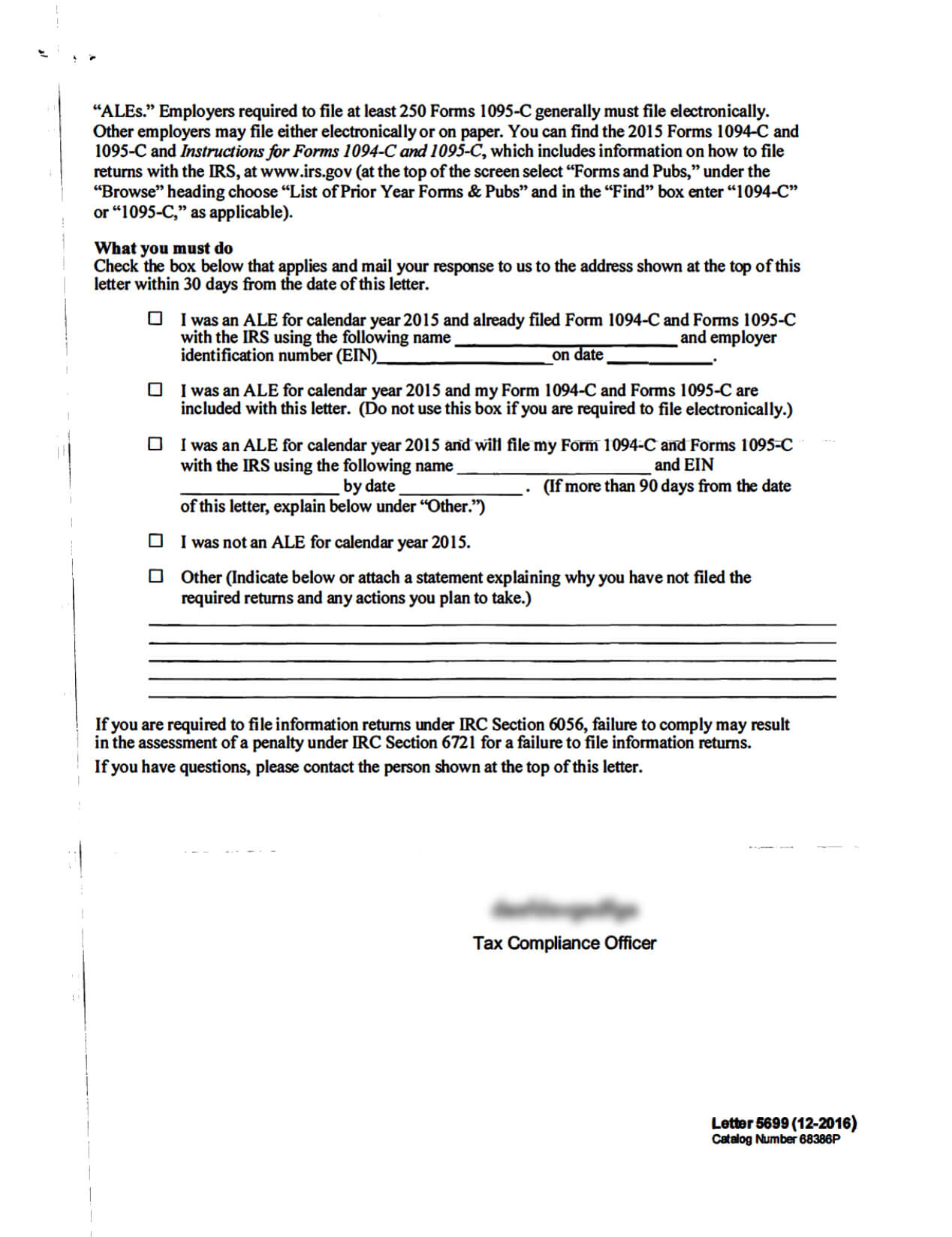

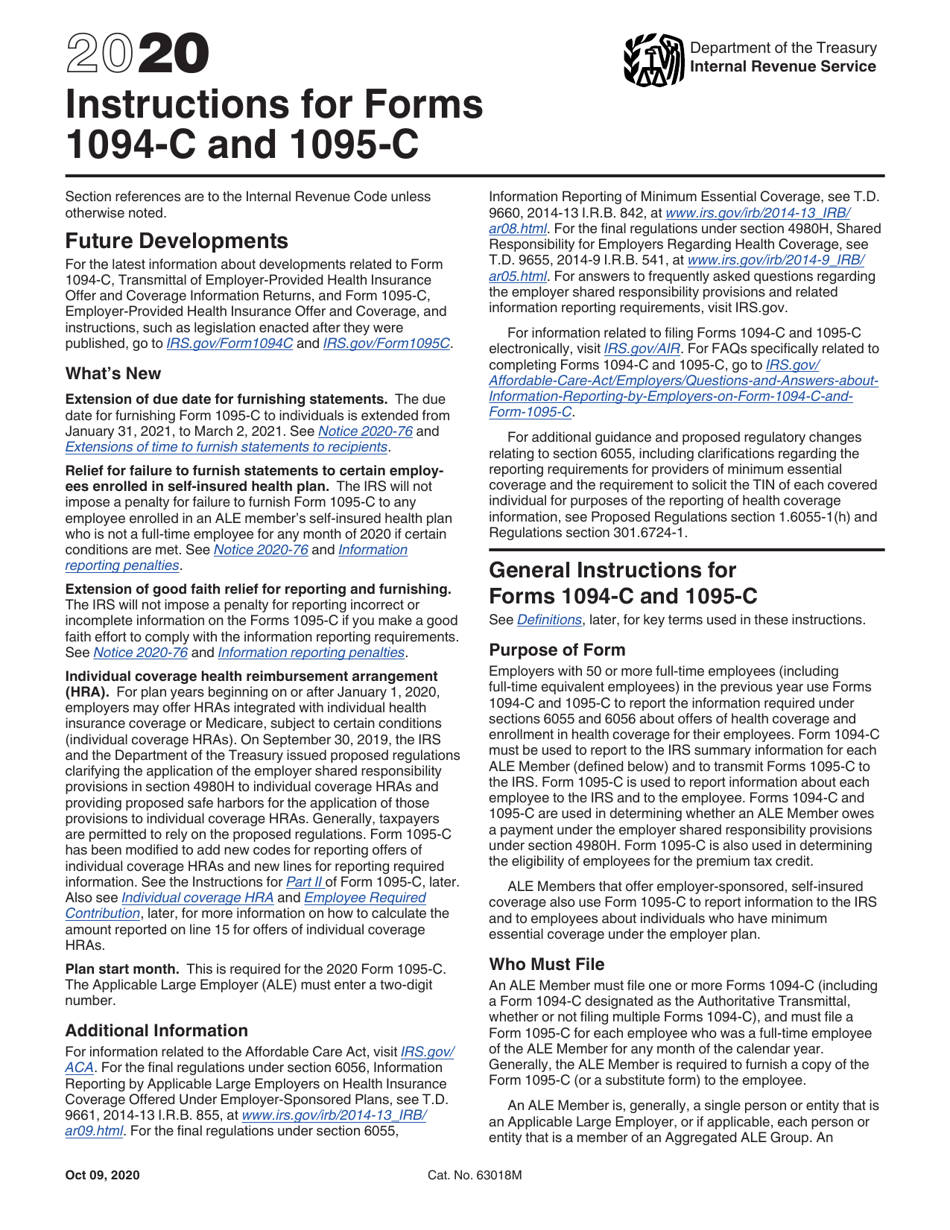

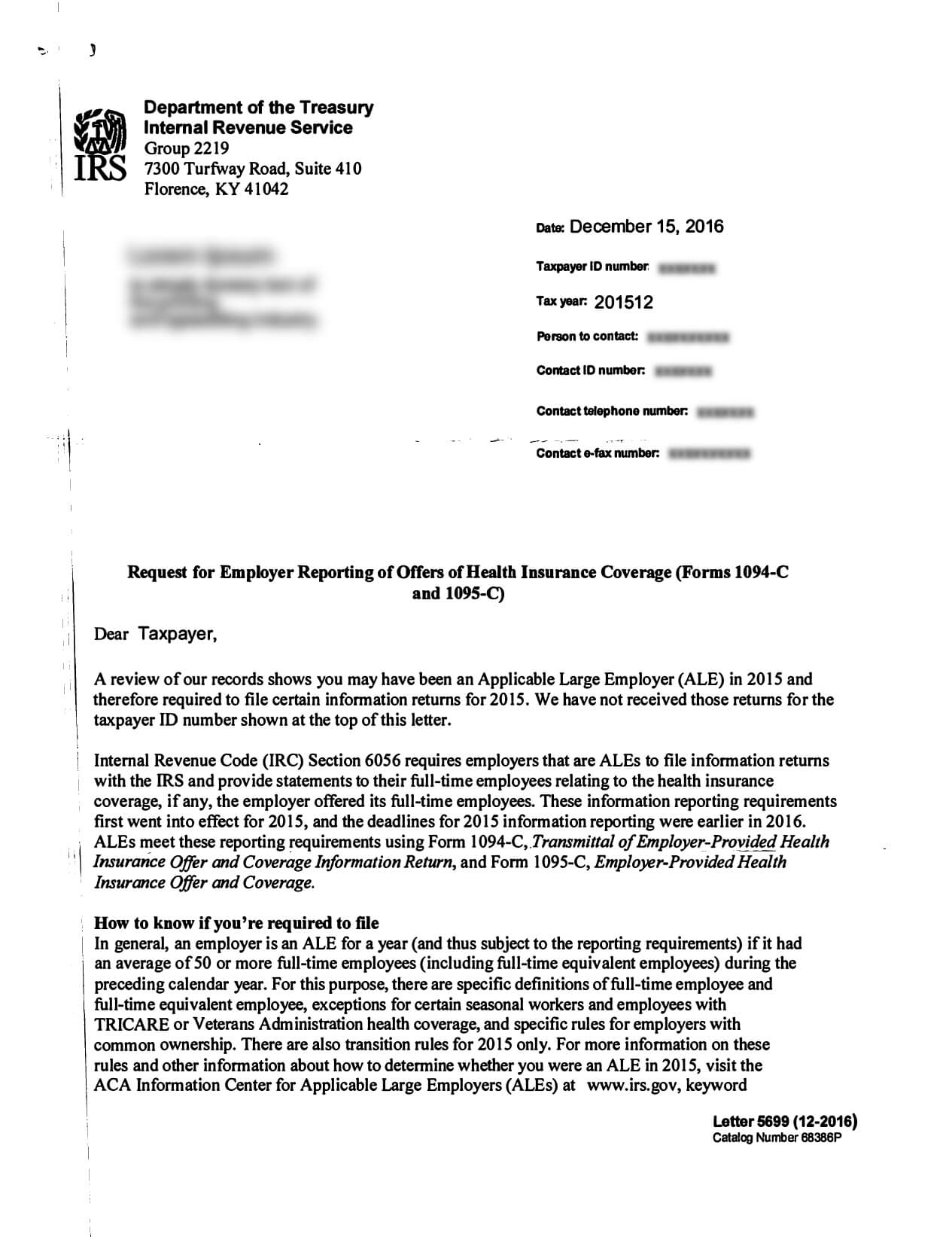

Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns 19 Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns 18 Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information ReturnsACA Form Draft IRS released drafts of Form 1094C and 1095C for ALE Status Calculator Use this calculator to determine your ALE status Letter 5699 A helpful resource for the employer about letter 5699 Letter 226J Helpful resource on Letter 226J (ESRP) BlogInstructions for Forms 1094C and 1095C Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about developments related to Form 1094C, Transmittal of EmployerProvided Health Insurance

Irs Issues Letter 5699 To Ales For Non Complaint With Aca Reporting

Ez1095 Software How To Print Form 1095 C And 1094 C

The Form 1094C can be thought of as a cover sheet for all of an organization's 1095Cs You must file one 1094C form per tax ID It requires information such as the number of people employed and how many 1095C forms are being filed Additionally, employers file the form only with the IRS and do not distribute it to employees « Back toA corrected Form 1095C must be sent along with a 1094C transmittal form Be sure to only check the "corrected" box on the Form 1095C, not 1094C A copy of the corrected form must also be furnished to the employee Again, refer to the IRS charts forInst 1094B and 1095B Instructions for Forms 1094B and 1095B Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Inst 1094C and 1095C

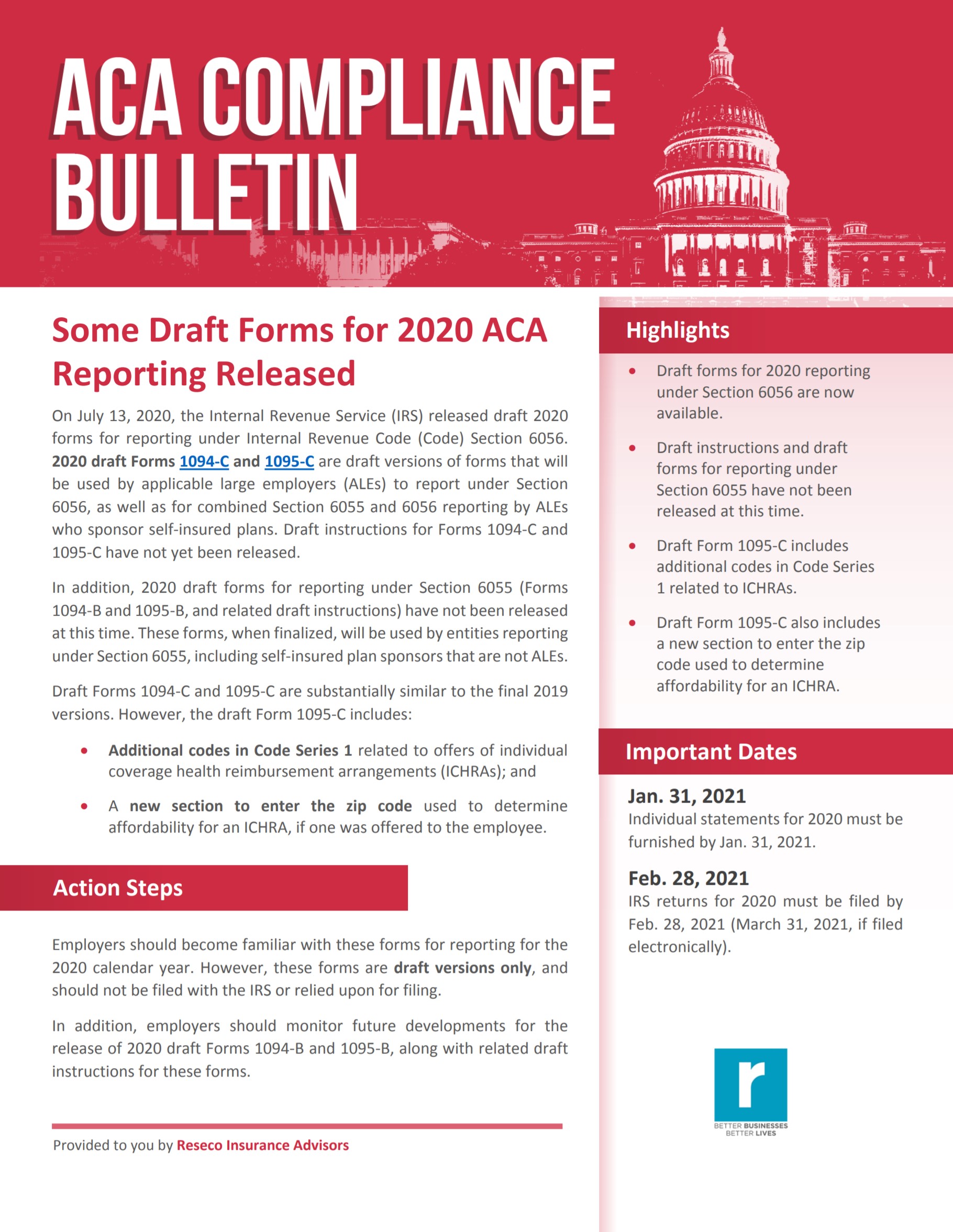

Some Draft Forms For Aca Reporting Released Resecō

2

For the filing year, Applicable Large Employers (ALEs) must provide Forms 1095C to employees by ALEs must submit Forms 1095C, along with Form 1094C, to the IRS by (if filed by mail) or (if filed electronically) Note Employers that are required to file 250 or more 1095C Forms must file electronicallyACA Reporting for Individual Coverage HRAs Posted by Matt Schwartz on Mon, @ 0910 AM The IRS recently released final instructions for both the 1094B and 1095B forms and the 1094C and 1095C forms and the final forms for 1094B, 1095B, 1094C, and 1095C The forms have generally remained unchanged from prior years The IRS issued final versions for four ACA forms, including Forms 1094B, 1095B, 1094C, and 1095C The forms can be accessed using the following links Form 1094B Form 1095B Form 1094C Form 1095C The IRS also released full instructions for Forms 1094C and 1095C for employers and HR teams, as well as instructions for Forms 1094

Www Irs Gov Pub Irs Prior Ib 19 Pdf

1095 C Form 21 Irs Forms

Prices start at $399 per form plus a $99 yearly chargeCalifornia Instructions for Filing Federal Forms 1094C and 1095C; What is the deadline to file ACA Form 1094 and 1095C An ALE should furnish an ACA Form 1095C to each of its fulltime employees by , for the calendar year An ALE should file ACA Forms 1094C and 1095C by , if you choose to file electronically, and the Form should file by , if filing on paper

Updated Hr S Guide To Filing And Distributing 1095 Cs Bernieportal

Www Ftb Ca Gov Forms 35b Publication Pdf

Form 1094C is used in combination with Form 1095C to determine employer shared responsibility penalties It is often referred to as the "transmittal form" or "cover sheet" IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement, which relates to the employer shared responsibility/play or pay requirement However, the IRS extended goodfaith transition relief from penalties to ALEs for incorrect or incomplete information on 1094C/1095C for the 15 through tax filing year, similar to the extension they provided during the 19 tax filing season Changes Coming for Form 1095C On , the Internal Revenue Service (IRS) provided a draft that shows changes to the tax forms for Rest assured Tango is reviewing and preparing to comply with the changes The 1094C form that gets transmitted to the IRS and shows the overall compliance for an EIN remains the same

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

2

Product Number Title Revision Date; Form 1094C and Form 1095C (and related instructions) will be used by applicable large employers (ALEs) to report under Section 6056, as well as for combined Section 6055 and 6056 reporting by ALEs who sponsor selfinsured plans These forms and instructions include a number of changes and clarifications related to reporting California Instructions for Filing Federal Forms 1094C and 1095C, FTB Publication 35C Author Webmaster@ftbcagov Subject , California Instructions for Filing Federal Forms 1094C and 1095C, FTB Publication 35C Keywords ;

1095 Aca Efile Xml File Errors And Solutions

2

Inst 1094C and 1095C Instructions for Forms 1094C and 1095C Inst 1094C and 1095C Instructions for Forms 1094C and 1095C The IRS has released final Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the tax year The Internal Revenue Service (IRS) has issued Notice 76, extending the deadline for employers to provide 1095B and 1095C forms to employees This is now the fourth year in a row that this extension has been offered The new deadline dates are as follows Forms 1094B and 1095C sent to individuals

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Generally, you must file Forms 1094C and 1095C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates For calendar year , Forms 1094C and 1095C are required to be filed by , or , if filing electronically The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby you offer sufficient insurance If you don't satisfy the Employer Mandate, there are fines Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095C

2

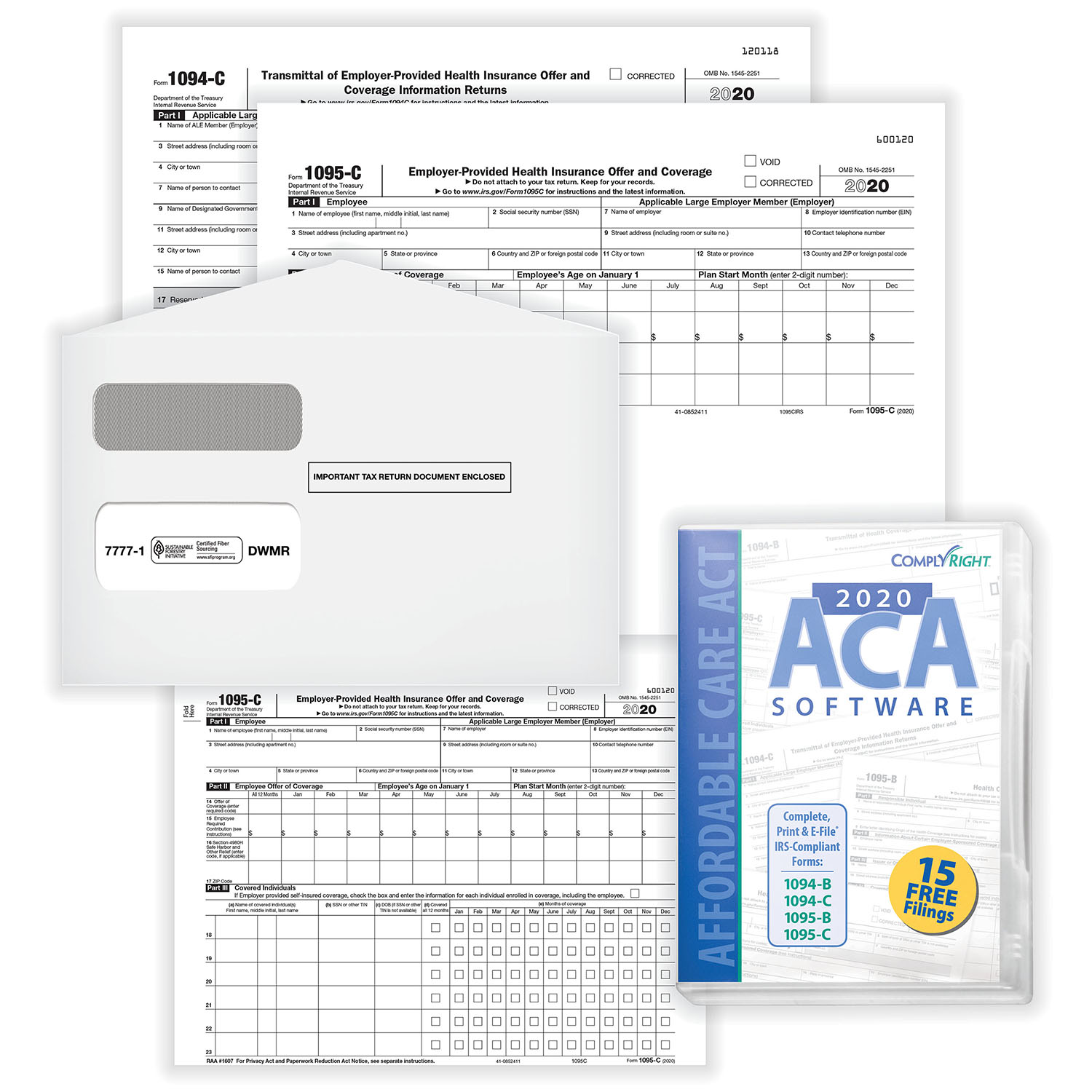

Affordable Care Act Form 1095 C Form And Software Hrdirect

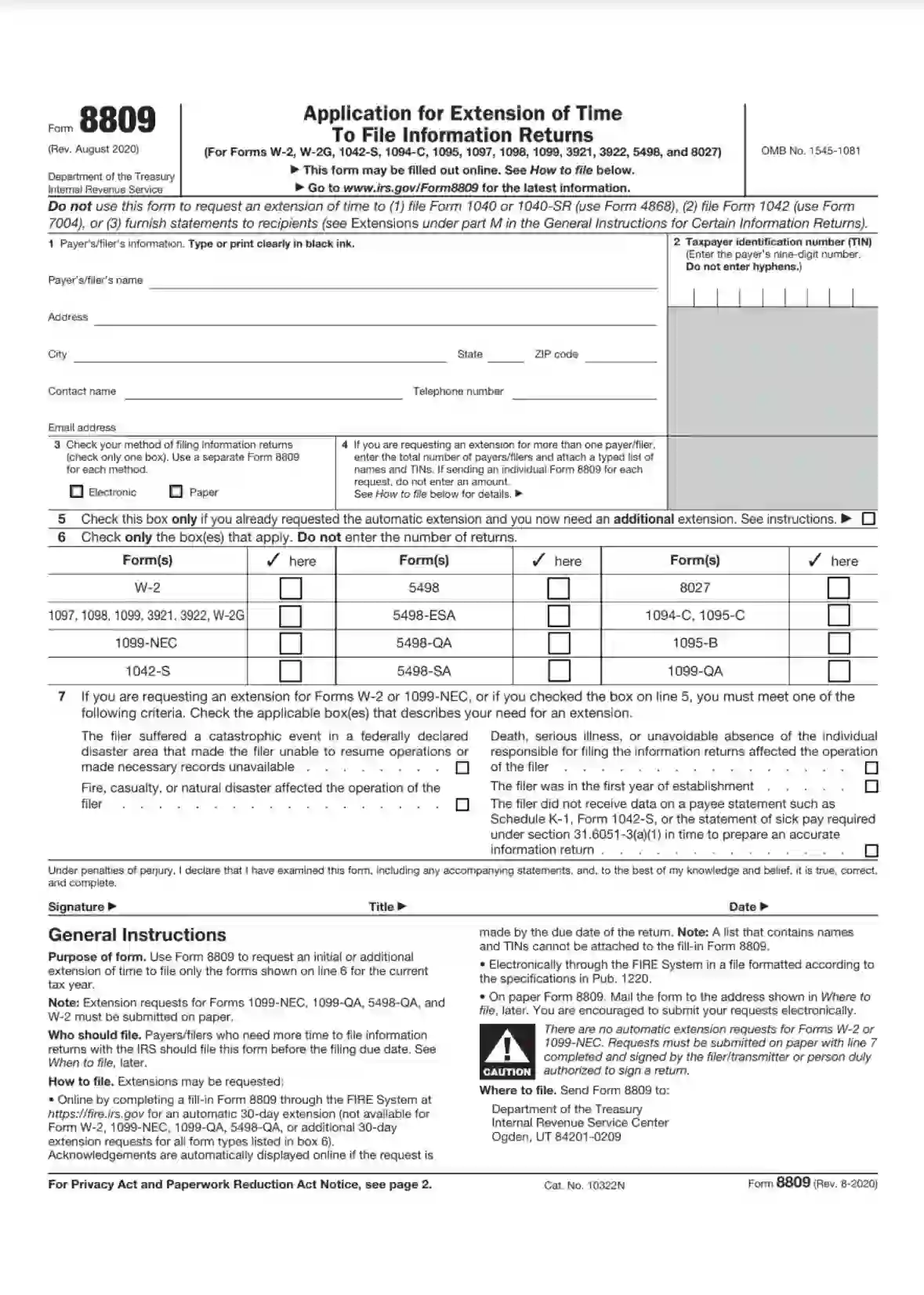

Selecting forms to edit or add to cart for purchase To enter a new 1099MISC or edit and existing one Use this page to review orders that you have already place and run your totals and summary reports To add a new filer or edit an existing one To add a Since the extension relief granted by the IRS through Notice 76 does not extend the due date for filing the Forms 1094B, 1095B, 1094C, or 1095C with the IRS, filers may still request an extension of time for good cause, and the automatic extension remains available under the normal rules for filers who submit a Form 09 on or before the due dateForm 1095C () Page 2 Instructions for Recipient See the Instructions for Forms 1094C and 1095C for more details The amount reported on line 15 may not be the amount you paid for coverage if, for example, you chose to enroll in more expensive coverage such as family coverage Line 15 will show an amount only if code 1B, 1C,

Centerpoint Fund Accounting Affordable Care Act Aca Forms Prepare And Print And Or Efile

Aca Deadlines Penalties Extension For 21 Checkmark Blog

You can import your forms from Excel, or key them in, and have them printed & mailed by The 1094B & 1094C summary transmittals will be filed by our SSAE 18 SOC I Type II secure Service Bureau by in the new electronic XML format! For calendar yr , Types 1094C and 1095C are required to be filed by , or , if submitting electronically You'll meet the requirement to file Types 1094C and 1095C if the kinds are correctly addressed and mailed on or earlier than the due dateFTB Publication 35C Created Date

Your 1095 C Obligations Explained

1095 B Submit Your 1095 B Form Onlinefiletaxes Com

1094 C Form Fill out, securely sign, print or email your 1094 c 10 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a The IRS released its draft IRS Forms 1094C and 1095C, dated as draft as of There are no changes to the Form 1094C from the prior year However, there are some significant changes to the 1095C Of course, depending on how these changes impact your reporting on 1095C, your reporting on the 1094C may also change IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the

Www Fairviewinsurance Com Index Htm Files Irs releases additional section 6056 codes for ichras Pdf

2

Form 1095C () Page 2 Instructions for Recipient See the Instructions for Forms 1094C and 1095C for more details The amount reported on line 15 may not be the amount you paid for coverage if, for example, you chose to enroll in more expensive coverage such as family coverage Line 15 will show an amount only if code 1B, 1C, The IRS has released the final versions of the ACA reporting Forms 1094C and 1095C, in addition to the reporting instructions for the tax year, to be filed and furnished by Applicable Large Employers (ALEs) in 21 You can find the final

2

Form 1094 C And 1095 C And Other Ale Consultations Haffraggiolaw

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

F Hubspotusercontent00 Net Hubfs 1095 C cheat sheet Employers Pdf

Irs 1094 C 21 Fill Out Tax Template Online Us Legal Forms

2

Help Zenefits Com Documents 446 Aca Form Gen Guide 1 Pdf

3

Form Irs 1095 B Fill Online Printable Fillable Blank Pdffiller

2

Updated Guidance Released On Employer Reporting For The California Individual Mandate Sequoia

Www Irs Gov Pub Irs Utl Instructions for ty19 criteria Based aats scenarios Pdf

2

7 Must Know 21 Hr Compliance Dates Workest

2

Http Webhelp Mpay Com Content Release Notes Release Notes 21 Tax Releasenotes Taxreleasepdfs Tax Release Notes 2101 7 Pdf

Www Ftb Ca Gov File Business Report Mec Info 35c Publication Draft Pdf

2

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Q Tbn And9gcsj2fd0y5g6r8mt9bhze7eiq3dikiuy6ur5pdhj7m9zdqnm8y O Usqp Cau

Www Irs Gov Pub Irs Drop N 76 Pdf

Irs Final Aca Compliance Forms Now Available Bernieportal

2

2

Irs Announces Changes With Aca Reporting Forms And Instructions Onedigital

Brsibenefits Com Wp Content Uploads Sites 3 15 05 Ichra Aca Reporting Requirements Pdf

1094 C Transmittal Of Employer Provided Health Insurance 1095c Coverage Info Returns 3 Sheets Form 100 Forms Pack

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

Irs Release Drafts Of Irs Forms 1094 C And 1095 C The Aca Times

Hcm Simplified

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Www Irs Gov Pub Irs Prior F09 Pdf

March 31 Is The Deadline For E Filing Aca Returns With The Irs The Aca Times

Irs Final Aca Compliance Forms Now Available Bernieportal

2

Aca Reporting Services Dayforce Ceridian

The Etc Companies Etccompanies Twitter

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Www1 Nyc Gov Assets Olr Downloads Pdf Health 1095 C Form Pdf

Amazon Com Form 1095 C Health Coverage And Envelopes With Aca Software Includes 6 1094 B Transmittal Forms Pack For 100 Employees Office Products

Form 1095 C H R Block

Aca Software Hrdirect

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

Updated Irs Reporting Requirements Babb Insurance

1095 C Faqs Mass Gov

Irs Form 09 Fill Out Printable Pdf Forms Online

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

2

2

Aca Elite Generate Codes E File 1095 C Forms

1094 C Transmittal Of Employer Provided Health Insurance 1095c Coverage Info Returns 3 Sheets Form 100 Forms Pack

2

Aca Compliance Bulletin Draft Section 6056 Reporting Forms Released Vcg Consultants

Irs Issues Letter 5699 To Ales For Non Complaint With Aca Reporting

Last Call Final 30 Day Extension For Aca Reporting Forms Furnished In 21 Abd Insurance And Financial Services

Form 1099 Nec Requirements Deadlines And Penalties Efile360

2

The Codes On Form 1095 C Explained The Aca Times

2

2

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

What You Need To Know About Aca Annual Reporting Aps Payroll

Filing Aca Forms 1095 B And 1094 B Youtube

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

2

Irs Extends Deadline To Provide Forms 1095 B And 1095 C

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

2

2

2

Deadlines Loom As Employers Prep For Aca Reporting In

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

0 件のコメント:

コメントを投稿